Choosing Best Bespoke Online Payment Systems Provider.

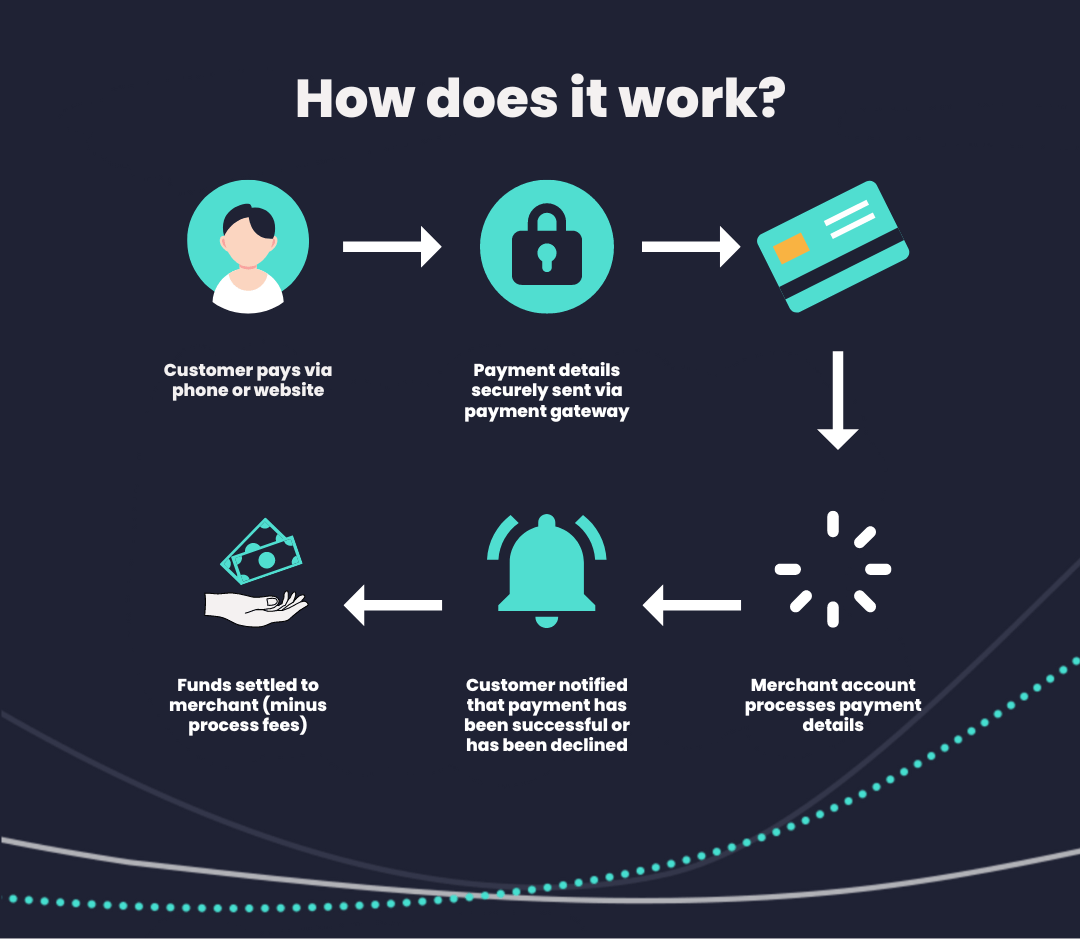

As a bespoke software development and support company, we have had to implement bespoke online payment models on more than one occasion. In most cases there are modules or components that one can use off-the-shelf, but there are cases where a business requires it done in a specific way and hence it needs a bespoke approach. In this blog post, I want to share some recent experience with these kinds of challenges.

Card transaction processing provider

There are so many card transaction providers out there. The main ones to mention are WorldPay, Stripe, and so on. The challenge when choosing the right provider is two-fold. Charges – how much do they charge per transaction, and secondly, Integration – how easy and quick can one integrate the service within the app. Given that there are potentially two different departments that are working together, there may be some tension. The finance department gravitates towards the cheaper provider, whilst the software development department is gravitating towards the provider with better documentation and tools / technology stack to work with. Who wins is not clear, it varies from company to company, but making the right decision is important. So if you are the director and you don’t know who to listen to, the software developer or the finance director, here is a third-person opinion for you.

Provider’s technology and documentation

This is what the software developer will be shouting about. After all, it is the developer that will need to do the integration, and not only that, but maintain it for years afterwards. Many businesses discount the cost of maintenance because it is not quite as easy to see. A developer might be on a salary and all the developer does on a day-to-day just gets mixed and there is no clear distinguishing between what time was spent on exactly what. If we were to assume that the expense for a developer is £100 per day, and that developer spends 1 day a month supporting the integration, then you need to add that £100 per month to the expense projection for the given provider when making they decision to go with them or not. Also, if the technology stack that the card transaction provider is not quite up-to-date, then future business requirements might be hindered which implies costs. Someone said, “if you think good architecture is expensive, then try bad architecture”. Choosing a provider with modern technology and good architecture as well as good developer’s documentation, will yield savings in the long-term. The only issue here is that from the outset, it is hard to visualise and grasp what those savings are (or will be). And that is why, usually, the provider with cheaper rates wins, because the savings are clear to see. That is why, whenever the developer is also the business owner and key decision maker, s/he will always go for the better technology rather than the cheaper rates. Recently, we had to implement payment models for a customer and the choice was Stripe. Stripe offers superior technology and documentation. The benefit that that provides the business is that more tasks can be automated. Again, how much have you saved by automating a given task, nobody knows, which is again missed by most management personnel, because it is difficult to quantify. We were able to quickly and easily integrate the Stripe Checkout Session payment model, as well as the Stripe Payment Links payment model. It saved time, and resources, because manual tasks were automated.

Provider’s charges

This is where the business owner likes to spend most of their time when making the decision. It is easy. If the business makes 100 transactions per day, on average each transaction is £50, then the charges are these, which is less than another provider, so we go with the cheaper. This was the case with a recent customer. The customer in question chose Paysafe Netbanx because of the very good rates. The project was PHP based and it required 3D Secure (3DS) as well. The documentation was not very good, the customer services was not very good, and so the developer wasted many hours going in circles. Needless to say, due to the bad documentation and lack of good testing environments, mistakes were made and the project was not quite smooth at all. The developer tried to advise the customer about better providers, but the low rates won the customer over and so the struggle had to be endured. The project was delivered late and cost more than anticipated. And next time changes will need to be made to the integration, it is likely that more issues will arise. And the question all the time is, how much are you actually saving by going with a cheaper provider after all? How long are they going to keep those lower rates for?

Conclusion

When choosing a online card payment processing provider to integrate into your application, the provider with cheaper rates, is not always the cheapest. There are “soft” costs that are difficult to see, but they are there and over time, they can only be seen when looking back. The software developers do have valid points during the decision making and those points need to be heeded. Bad architecture will always cost you more in the end and make the ride that much more bumpy. Choosing something more modern and easy to integrate (via API) will give the business more flexibility in the way it collects payments, both present and future.

If you have the requirement to integrate an online payment method into your application, then we have both good and bad experience. We know what works and what does not. As a bespoke software development company, we can do it for you from start to finish. We know API integration and custom web development. Call us.